Calculate depreciation rental property irs

The following process describes how to calculate the depreciation of the rental property based on the purchase of the property. You can deduct depreciation only on the part of your property used for rental purposes.

Bonus Depreciation Calculator In 2022 Savings Calculator Bonus Real Estate

In our example lets use our existing cost basis of 206000.

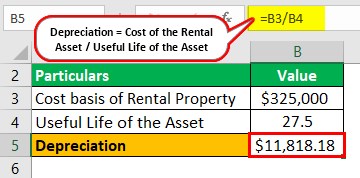

. 1 Best answer. What is the best depreciation method for rental property. To calculate the annual amount of depreciation on a property you divide the cost basis by the propertys useful life.

Lets say that the original depreciable value of a rental property was 100000 and the investor owned the property for 30 years and all the depreciation 100000 has been used or taken. You should follow the same process for any. June 7 2019 308 PM.

In this step you take your cost basis from step one and divide it by the years that your rental property is considered to have a useful life. There are two types of MACRS. This determines the amount per year that can be depreciated for properties that were in service for the whole year.

Divide Cost by Lifespan of Property. For a married couple filing jointly with a taxable income of 280000 and capital gains of. If your taxable income is 496600 or more the capital gains rate increases to 20.

Divide the basis by the recovery period. GDS is the most popular method for spreading out the depreciation of rental property over its useful life which the IRS. Residential rental property owned for business or investment purposes can be depreciated over 275 years according to IRS Publication 527 Residential Rental.

Calculating depreciation using macrs methods becomes easy with the. The depreciation method used for rental property is MACRS. A rental property owner needs to understand the IRS process.

What is the best depreciation method for rental property. IRS has precise rules to determine the propertys useful life and depreciation. GDS is the most.

Generally depreciation on your rental property is the based on the original cost of the rental asset less the value of the.

What The Irs Says About Cost Segregation Federal Income Tax Irs Income Tax

Rental Property Depreciation Rules Schedule Recapture

Increase The Rate Of Return With Cost Segregation Tax Reduction Income Tax Study Help

Depreciation Residential Vs All Other Archer Investors

Depreciation Calculator For Home Office Internal Revenue Code Simplified

How To Calculate Depreciation On A Rental Property

How To Calculate Depreciation Expense For Business

How To Calculate Depreciation For Federal Income Tax Purposes Tax Reduction Federal Income Tax Income Tax

Depreciation For Rental Property How To Calculate

Straight Line Depreciation Calculator And Definition Retipster

Rental Property Depreciation Rules Schedule Recapture

The Irs Atg States Tax Reduction Helpful Hints Irs

Depreciation For Rental Property How To Calculate

How To Calculate Depreciation On Rental Property

Rental Property Profit Calculator Watch Quick Video Mortgageblog Com

The Sales Proceeds Calculation Home Mortgage Real Estate Investing Rental Property

What Is Bonus Depreciation In 2022 Tax Reduction Bonus Net Income